ESG has evolved into a boardroom and operational priority. Once considered a ‘nice-to-have’, environmental, social, and governance (ESG) considerations are now central to business strategy, investment decisions, and regulatory compliance. As global capital increasingly flows towards ESG-aligned companies, regulators and markets are responding with rigorous disclosure standards. In Malaysia, initiatives from Bursa Malaysia and broader national policy commitments reflect this shift.

While ESG is high on the corporate agenda, the way it is viewed and implemented often differs between Boards, CEOs, and Executives. This article explores the growing momentum around ESG, contrasts how different leadership levels perceive its value, and outlines how companies can harmonise those views to accelerate impact.

Table of Contents

Macro Trends: Regulatory Pressure and Investment Realignment

The rise of ESG is driven by three major forces:

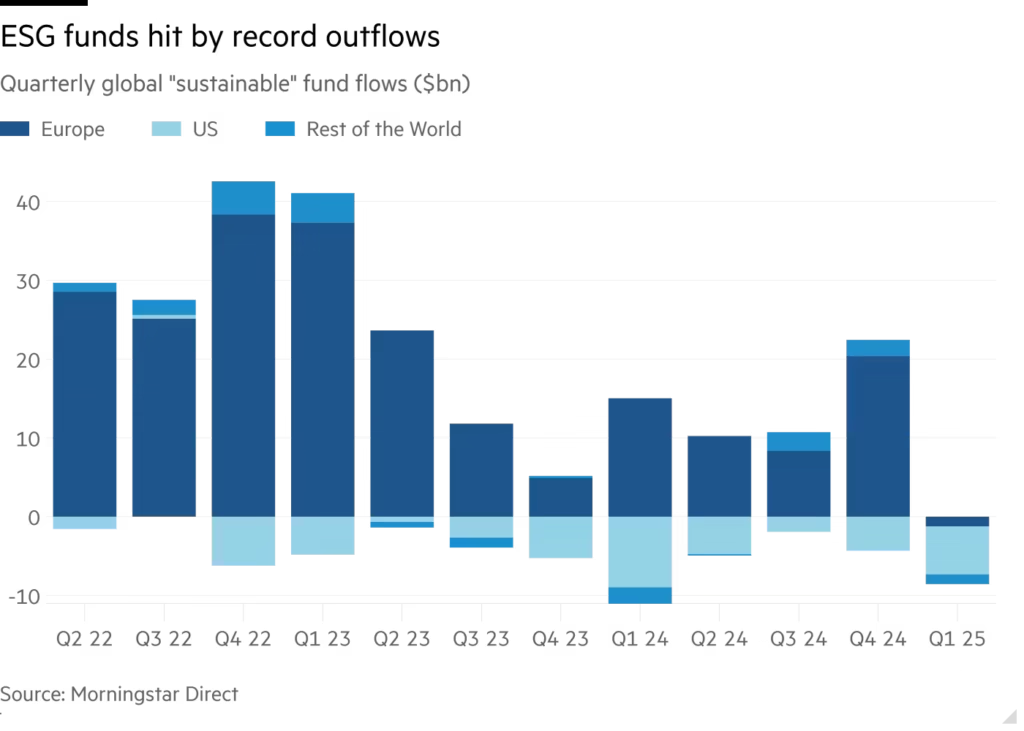

- Investor Expectations: ESG investing is maturing, with investors demanding authenticity and measurable impact. European pension funds have withdrawn from asset managers such as BlackRock and State Street over weak climate commitments, while in the US, political pushback has led to a fragmented ESG landscape.

The implication for businesses is clear: to remain attractive to investors, companies must embed credible ESG strategies into core operations—not just reporting—to avoid greenwashing and maintain access to capital.

- Regulatory Demands: Jurisdictions around the world are rolling out stringent sustainability disclosure regulations. The European Union’s Corporate Sustainability Reporting Directive (CSRD), the International Sustainability Standards Board (ISSB) frameworks, and regional initiatives like Malaysia’s Sustainable and Responsible Investment (SRI) Taxonomy are compelling businesses to provide reliable ESG data.

- Consumer Consciousness: Public awareness around climate change, social justice, and ethical governance is pushing brands to align with sustainability values or risk reputational damage.

In Malaysia, regulatory and market forces are converging. Bursa Malaysia is urging stronger ESG reporting at the board level, while national strategies position Malaysia as a regional leader in sustainable development.

Differing Perspectives: Boards, CEOs, and Executives

Achieving ESG success requires cohesive alignment across all leadership levels. From our experience working with clients, each group brings distinct perspectives and roles to the ESG journey:

Boards: Governance and Oversight

Boards are the custodians of long-term value. Their ESG priorities include:

- Ensuring compliance with global reporting frameworks (e.g., ISSB, TCFD, Bursa guidelines)

- Overseeing ESG-related risks and integrating them into enterprise risk management

- Safeguarding shareholder value and corporate reputation

Boards typically focus on strategy and disclosure but may lack hands-on visibility into operational execution, relying heavily on management teams.

CEOs: Strategy and Business Impact

CEOs play a dual role, translating board direction into actionable business plans. Their ESG priorities include:

- Positioning the company for sustainable growth and investor confidence

- Unlocking access to green financing and ESG-linked opportunities

- Driving innovation through sustainability-focused products and services

They must balance high-level ESG ambitions with financial performance and market dynamics. CEOs are the key to connecting board governance with day-to-day execution.

Executives: Execution and Performance

Executives lead the implementation of ESG across functions. Their ESG role includes:

- Integrating ESG into departmental KPIs and compliance efforts

- Driving efficiency and improvements (e.g. energy use, procurement, HR practices)

- Reporting data and insights to support disclosures and strategic decisions

They often face practical hurdles such as limited resources or unclear mandates. Without strong alignment from the top, ESG efforts risk becoming siloed or superficial.

Bridging the Gap: Four Actions for ESG Leadership Alignment

To bridge these differing perspectives and create unified ESG action, organisations can consider:

- Create a Shared ESG Narrative

Craft a compelling and consistent ESG vision that is communicated across all levels. This shared narrative should link ESG to the company’s broader mission, customer expectations, and commercial advantage. When all leaders understand the “why” behind sustainability, it becomes easier to inspire buy-in and shape culture. - Build ESG Fluency Across Tiers

Equip each leadership tier with role-relevant ESG knowledge. For boards, this might mean deepening understanding of climate-related financial disclosures. For executives, it may involve training on ESG data collection, reporting tools, or operational best practices. Fluency reduces ambiguity and enhances collaboration. - Foster Structured Collaboration

Create formal mechanisms that encourage joint ownership of ESG outcomes. This could include cross-functional ESG taskforces, regular alignment meetings, or dashboards shared between departments and leadership levels. Collaboration ensures ESG isn’t siloed and promotes collective accountability. - Integrate ESG into Strategic Planning Cycles

Embed ESG considerations into business planning, investment evaluation, and innovation strategy. By making ESG a filter through which all major decisions are viewed, companies can shift from reactive compliance to proactive value creation. Alignment is reinforced when ESG is linked to growth targets and risk frameworks.

ESG is no longer just a compliance checklist or investor buzzword. It is a critical enabler of business resilience, innovation, and stakeholder trust. As Malaysia deepens its ESG agenda through regulatory and strategic leadership, companies must rise to the occasion.

By aligning the oversight of the Board, the strategic foresight of CEOs, and the operational expertise of Executives, organisations can bridge internal divides and drive holistic, lasting change. In doing so, they not only meet regulatory expectations but also contribute meaningfully to the environment, society, and sustainable economic growth.

By offering a one-stop platform for sustainable innovative solutions, BBC empowers companies to not only develop effective strategies but also to translate those strategies into tangible results, creating a more sustainable and profitable future.

Explore our comprehensive range of solutions below now.

Make business decisions with sustainability in mind

Enhance your understanding of ESG and sustainability through our engaging and interactive e-Learning courses and public workshops at Bernard Business Academy.

Develop a comprehensive and strategic ESG and sustainability framework by accurately measuring, reporting, and verifying your ESG performance and carbon footprint.

Reduce your carbon footprint through the adoption of sustainable and innovative solutions.